Unraveling The Legacy: Who Inherited John F. Kennedy's Money?

For many, the name John F. Kennedy, or JFK, truly evokes a powerful sense of history, a time of great hope and, you know, quite a lot of public fascination. His life, and indeed his tragic passing, left an indelible mark on the world. It is, perhaps, only natural that people often wonder about the more personal aspects of his existence, especially when it comes to his private wealth. What happened to his financial holdings? Who, in fact, received John F. Kennedy's money after he was gone? This question, it seems, just keeps coming up, and for very good reason.

When someone passes away, the concept of "inherit" becomes really important. As a matter of fact, to inherit means to receive from an ancestor, like a parent or grandparent, as a right or a title that passes down by law when that ancestor dies. It's about getting property, or perhaps a right or even a title, through a process of succession or because of what's written in a will. So, when we talk about who inherited JFK's money, we're essentially asking who received his possessions and financial assets after his death, according to legal procedures.

This curiosity isn't just about dollar figures; it's also about the continuation of a family's story, you know, the way things get handed down. We often hear about people inheriting particular characteristics, like red hair or a certain way of speaking, which are received from parents through their genes. But in the financial sense, inheriting means that wealth, property, or even responsibilities are passed on from one generation to the next, often through formal legal steps. Today, we'll look at the details of how John F. Kennedy's personal fortune was handled, and who were the primary recipients of his estate, which is actually quite interesting.

Table of Contents

- JFK: A Brief Look at His Life

- Personal Details and Bio Data of John F. Kennedy

- Understanding Inheritance in the Kennedy Context

- The Assets of a President

- Who Were the Primary Inheritors?

- The Role of Trusts and Family Wealth

- Common Questions About JFK's Inheritance

JFK: A Brief Look at His Life

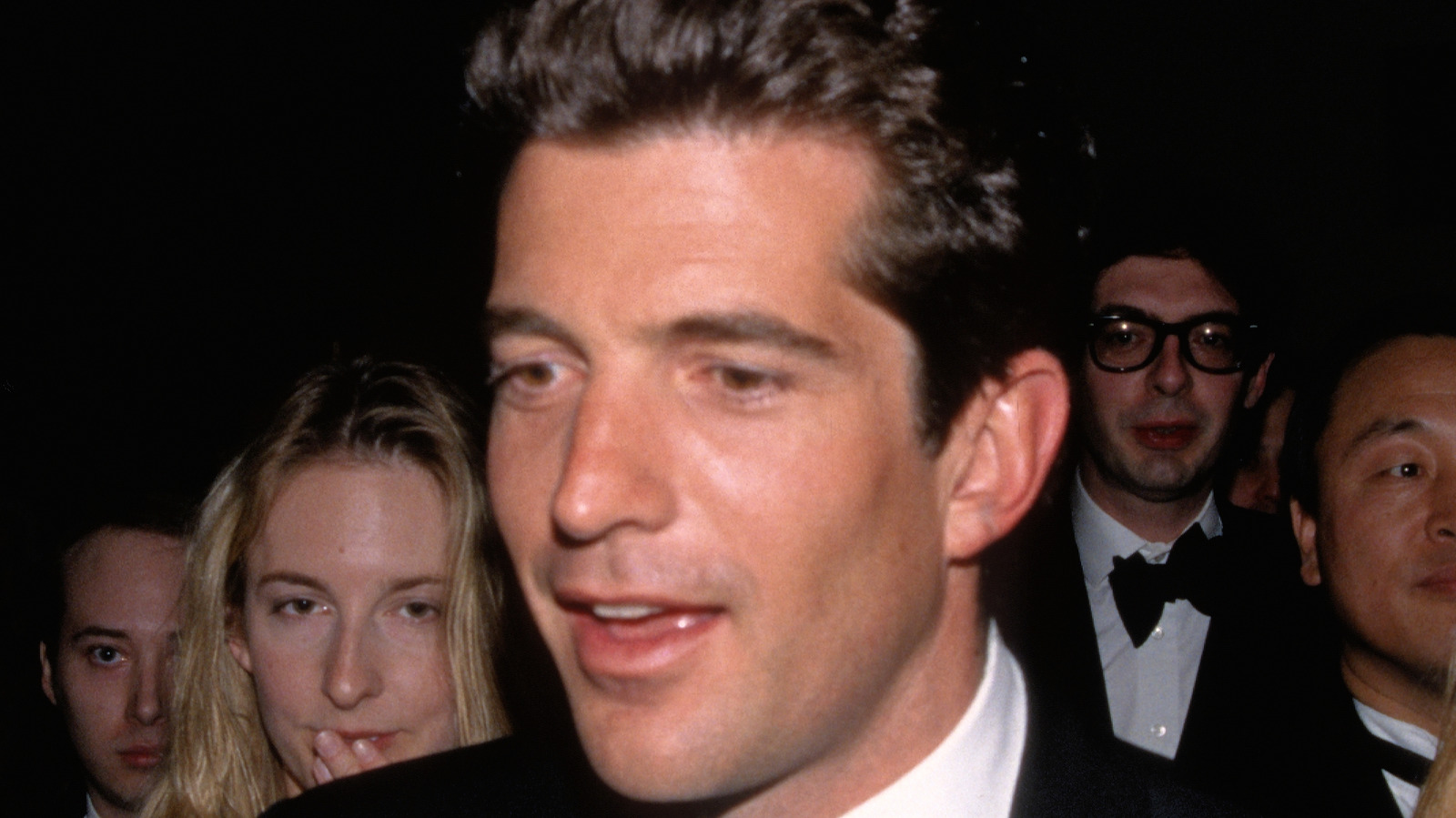

John Fitzgerald Kennedy, a truly iconic figure, served as the 35th President of the United States. His time in office, though tragically cut short, is remembered for many significant moments, including the Cuban Missile Crisis, the Space Race, and the push for civil rights. Born into a prominent and wealthy family, he was, you know, groomed for public service from a rather early age. His life, from his military service during World War II to his political career, was certainly one of immense public scrutiny and influence. He represented a new generation of American leadership, and his vision, in some respects, still resonates with people today.

Personal Details and Bio Data of John F. Kennedy

Here are some key facts about John F. Kennedy, providing a bit of context for his life and the circumstances surrounding his personal estate.

| Detail | Information |

|---|---|

| Full Name | John Fitzgerald Kennedy |

| Born | May 29, 1917 |

| Birthplace | Brookline, Massachusetts, USA |

| Died | November 22, 1963 (aged 46) |

| Place of Death | Dallas, Texas, USA |

| Spouse | Jacqueline Lee Bouvier (married 1953) |

| Children | Caroline Bouvier Kennedy, John Fitzgerald Kennedy Jr. |

| Parents | Joseph P. Kennedy Sr., Rose Fitzgerald Kennedy |

| Education | Harvard University |

| Political Party | Democratic |

| Presidential Term | January 20, 1961 – November 22, 1963 |

Understanding Inheritance in the Kennedy Context

When we talk about someone like John F. Kennedy and what happened to his money, it's really important to understand what "inherit" means in a practical sense. My text explains that to inherit is to receive from an ancestor as a right or title that can be passed down by law at the ancestor's death. This means that when JFK passed away, his assets—his property, his investments, and other valuable things—would be transferred to specific individuals according to legal procedures, or perhaps a will he had made. It's not just about money, you know, but also about rights and sometimes even obligations that get handed down.

The concept of "inherited" also refers to the transfer of characteristics, or traits, or property, or even rights, from earlier generations. This can happen through natural biological processes, like getting your mother's eye color, or through legal procedures, which is what we're discussing with JFK's estate. So, his family members, the ones who were designated, would receive these things from him. It's a bit like a new coach becoming an inheritor of a great team's legacy; they receive something significant that came before them. In this case, it's about actual wealth and possessions, which is quite a tangible thing.

The legal framework around inheritance ensures that a person's wishes, if expressed in a will, are followed, or that state laws dictate how assets are distributed if no will exists. For someone of JFK's stature, it's very likely that careful planning was involved, given the family's history with wealth and, you know, their general approach to financial matters. The process means that things received from someone who has died are formally transferred. It’s a very structured way of handling what a person leaves behind, ensuring that their estate is managed and distributed correctly, which is something many families have to consider.

The Assets of a President

John F. Kennedy, even as President, had personal assets that were separate from the public funds. His wealth, it's worth noting, largely stemmed from his family's considerable fortune, built by his father, Joseph P. Kennedy Sr., through various business ventures, including banking, real estate, and investments. So, JFK himself wasn't, you know, building a vast personal empire during his presidency; rather, he was a beneficiary of an already established and very substantial family trust. His own personal holdings likely included things like real estate, personal investments, and perhaps some valuable personal items.

While the exact figures of his personal net worth at the time of his passing are not widely publicized in precise detail, it's understood that he possessed a comfortable level of personal wealth, separate from the much larger Kennedy family fortune. This personal wealth would have been subject to his will and the laws of inheritance. It's important to distinguish between his individual estate and the broader family trusts, which were set up by his father to benefit all the Kennedy children and their descendants for generations. This structure, you know, actually provided a financial safety net for the entire family, which was quite a foresightful move.

Any assets he held directly, such as his share of family properties, personal bank accounts, or specific investments made in his own name, would form his individual estate. This estate would then be subject to the legal process of probate, where a court oversees the distribution of a deceased person's assets. It's a rather formal procedure that ensures everything is handled according to the law and any existing will. This distinction between personal assets and family trusts is, in some respects, key to understanding the full picture of the Kennedy family's financial arrangements.

Who Were the Primary Inheritors?

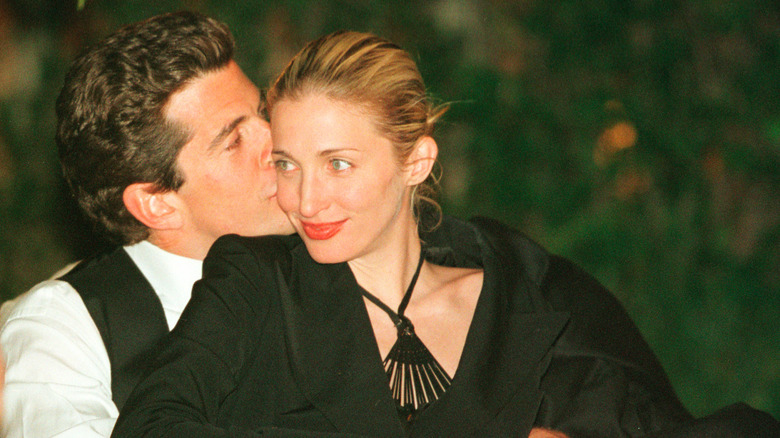

When John F. Kennedy died, the primary individuals who stood to inherit from his personal estate were his wife, Jacqueline Kennedy, and their two surviving children, Caroline and John Jr. The way assets are distributed after someone's death is, you know, generally determined by a will, if one exists, or by state laws if there isn't a will. Given the Kennedy family's careful financial planning, it's widely understood that JFK had made provisions for his immediate family, ensuring their financial security after his passing. This was, perhaps, a very natural concern for someone in his position.

The concept of "all her children stand to inherit equally" from my text might apply to how his children were treated, though specific details of his will are not public knowledge. What we do know is that his closest family members were the direct recipients of his personal wealth. This means they received property, or funds, or other valuable items, directly from his estate. It's the classic definition of "received from someone who has died," which is, you know, the very essence of inheritance. These individuals were the ones who would carry on his direct financial legacy.

Jacqueline Kennedy Onassis

Jacqueline Kennedy, his beloved wife, was, of course, a central figure in his life and, very naturally, a primary beneficiary of his estate. As a spouse, she would typically receive a significant portion of his personal assets, either outright or through trusts established for her benefit. Her financial well-being after his death was a paramount concern, and provisions would have been made to ensure she had ample resources. This is a common arrangement in many estates, where the surviving spouse is taken care of first, which is, you know, a very important consideration.

Beyond direct inheritance, Jacqueline also inherited, in a way, the enormous public legacy and responsibility that came with being the widow of a revered president. While not a financial inheritance, it was a significant aspect of her life after his death. She received, you know, a public role that was, in some respects, handed down to her by circumstance. Her grace and strength in the face of tragedy also became part of this inherited public persona, which is quite a profound thing.

Caroline Kennedy

Caroline Kennedy, JFK's daughter, was quite young at the time of her father's passing. As a minor child, her inheritance would have been placed into trusts, managed by appointed trustees until she reached a certain age, often 21 or 25, or even later. This is a very common practice to protect assets for young beneficiaries and ensure they are managed wisely. So, she would receive her share of the inheritance, but not directly until she was older, which is a sensible approach for children.

Her inheritance would have included a portion of her father's personal estate, ensuring her financial security throughout her life. The money she inherited, you know, was something that was handed down to her by her family, specifically from her father. It was a tangible asset that she would eventually gain control over, allowing her to pursue her own endeavors without immediate financial worry, which is, in some respects, a great advantage.

John F. Kennedy Jr.

Like his older sister Caroline, John F. Kennedy Jr. was also a very young child when his father died. His share of the inheritance would have been handled similarly, placed into trusts for his benefit until he reached the age of majority or a specified age outlined in the trust documents. This arrangement protected his financial interests and ensured that the funds would be available to him when he was mature enough to manage them himself. It's a very standard way of handling inheritances for children, actually.

He, too, received assets that were handed down to him by his family, just like his sister. The idea that "inherited means handed down to you by your family" truly applies here. These funds provided a foundation for his future, allowing him opportunities that might not have been available otherwise. He was, in a very real sense, an inheritor not just of money, but also, you know, of a profound family legacy, which is quite a heavy thing to carry.

The Role of Trusts and Family Wealth

It's important to understand that John F. Kennedy's personal estate was part of a much larger, intricate web of family wealth, primarily managed through various trusts established by his father, Joseph P. Kennedy Sr. These trusts were designed to preserve and grow the family's fortune across generations, providing financial stability for all the Kennedy children and their descendants. So, while JFK had his own personal assets, a significant portion of the wealth that benefited him and his children came from these broader family structures, which is, you know, a very common strategy for wealthy families.

A trust, in this context, is a legal arrangement where assets are held by one party (the trustee) for the benefit of another (the beneficiary). This setup offers advantages like tax efficiency, protection from creditors, and the ability to control how and when beneficiaries receive funds. For the Kennedy family, these trusts ensured that the wealth would be managed professionally and distributed according to specific long-term plans, rather than being simply handed out all at once. This kind of arrangement can be quite complex, actually.

So, while Jacqueline, Caroline, and John Jr. inherited directly from JFK's personal will, they also benefited significantly from the ongoing distributions from these large family trusts. This dual layer of financial support meant that their financial security was robust, extending beyond just what JFK personally owned at the moment of his death. It's an example of how "inherited refers to the transfer... of property, rights, or obligations from preceding generations through... legal procedures," which is a very comprehensive way to manage wealth over time. This structure, in some respects, shaped the financial lives of the Kennedy descendants for decades.

To learn more about the broader Kennedy family finances and their historical impact, you might find information on reputable historical archives quite helpful. For instance, you could explore resources like the John F. Kennedy Presidential Library and Museum's digital archives, which often contain details about the family's public and private life, including aspects of their financial arrangements. It's a truly fascinating area of study, you know, for those interested in American history and family legacies.

Learn more about family estates on our site, and link to this page inheritance laws.

Common Questions About JFK's Inheritance

What was John F. Kennedy's net worth at the time of his death?

Pinpointing an exact net worth for John F. Kennedy at the time of his passing is, you know, a bit challenging, as specific figures are not widely publicized. However, it's understood that he came from a very wealthy family, and his personal assets, combined with his share of family trusts, meant he had substantial financial resources. His wealth was largely derived from the fortune amassed by his father, Joseph P. Kennedy Sr., which was managed through complex trust structures for the benefit of all family members. So, while he wasn't a self-made billionaire, he was certainly a very wealthy man, which is, in some respects, a key detail.

Did JFK have a will?

While the specifics of John F. Kennedy's will are not public documents, it is widely presumed that he had one, given his prominent status and the family's sophisticated approach to financial planning. People of his stature and wealth typically create wills to ensure their assets are distributed according to their wishes, rather than relying solely on state inheritance laws. Such a document would have outlined how his personal property, investments, and other assets were to be passed on to his wife and children. It's, you know, a very standard practice for someone with significant holdings.

How did the Kennedy family manage their wealth across generations?

The Kennedy family, under the guidance of Joseph P. Kennedy Sr., managed their vast wealth primarily through a series of trusts. These trusts were designed to provide long-term financial security for future generations, minimize estate taxes, and protect assets. Rather than distributing large sums of money directly, the trusts provided regular income and capital distributions to family members over many years. This sophisticated approach ensured that the wealth would endure and support the family's public service and private endeavors for a long time, which is, you know, a very clever way to handle things.

Who Inherited JFK’s Money? Kennedy Family Wealth Explained

Here's Who Inherited John F. Kennedy Jr.'s Money After He Died

Here's Who Inherited John F. Kennedy Jr.'s Money After He Died